A business owner who is aware of the deductions available to them may be what is tax liabilities on w2 able to invest more in growing their business, aware that some of the costs will be offset later. Understanding how much you owe the federal government, and how much you’re ultimately responsible for paying, can help you make smart financial decisions. Your tax liability is the amount you owe to the IRS or your local government. Tax liability coverage protects against certain supportable tax positions that don’t qualify for the anticipated tax treatment.

Access additional help, including our tax experts

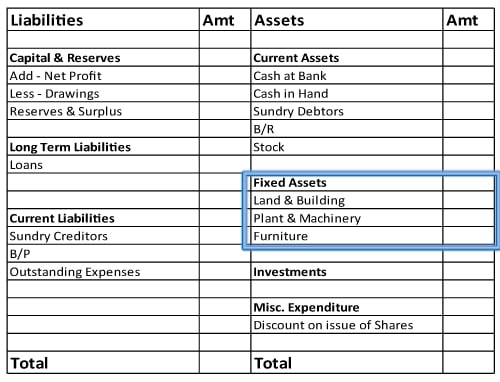

Here are 10 common adjustments that can help reduce your overall AGI, which may Partnership Accounting lead to lower taxes owed. Always check eligibility for these deductions according to current tax laws. The bottom line is that you must pay the balance on line 37 of your tax return as quickly as possible to avoid paying interest and penalties on the amount until it’s paid off. You can expect a refund from the IRS if the difference between taxes paid and your total tax liability results in a negative balance. The identifying information section of the W-2 is essentially a tracking feature.

Which tax credits are refundable?

- Free filing of simple Form 1040 returns only (no schedules except for Earned Income Tax Credit, Child Tax Credit and student loan interest).

- An exemption reduces taxable income by a specific dollar amount per person claimed on your return (such as yourself or any dependents).

- These standard deduction amounts are subtracted from the total of your earned income and you’re only taxed on the remaining balance.

- You also need to calculate deductions, credits, and exemptions, as these can help lower your tax liability and reduce the amount you owe.

- You’d receive the $500 difference directly if you have only a $500 tax liability and you’re eligible to claim a $1,000 refundable credit.

Your taxable income gets divided into income ranges—or brackets—with each range getting taxed at a certain rate. Several items can reduce your tax through deductions, but with the passing of the 2017 tax law, most individuals only claim unearned revenue their standard deduction. Also, consider the aforementioned capital gains and capital losses.

- One way to reduce your tax liability is to take advantage of any deductions and tax credits you’re eligible for.

- Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more.

- This ensures your tax records remain consistent and accurate each year.

- Our team of writers strives to provide accurate and genuine reviews and articles, and all views and opinions expressed on our site are solely those of the authors.

- Additionally, higher-earning spouses may face steeper taxes because of the net investment income tax (NIIT), potentially adding an additional 3.8% to their federal tax rate.

Tips for Accurate AGI Calculation

- This enables you to reduce the overall amount of taxes you pay on 401(k) contributions.

- Calculate your tax liability by determining your taxable income, subtracting deductions, applying tax rates, subtracting tax credits, and arriving at your total tax owed to the government.

- Their guidance can mean the difference between a smooth financial transition and costly mistakes that could affect your future stability.

- If you run a business with a deferred tax liability, you’ll pay taxes in the future.

- Each asset carries its own tax “DNA,” and decisions about selling property or liquidating investments can trigger unintended consequences.

- Georgia was blindsided by this enormous tax bill, which was the last thing she needed as a new homeowner.

- Employers must verify all payroll information, including employee names, Social Security numbers, and amounts reported in each box.

You also have the option of itemizing your deductions instead of claiming the standard deduction, but you can’t do both. Many filers find that their standard deductions are larger than the amount of itemized deductions they’re eligible to claim. You likely have a tax liability if you earn income or sell an asset. Filing your annual tax returns is the best way to determine your tax liability.

Choose a Reddit account to continue

You should see a breakdown on your paystub of each payroll tax amount and the collector. The software lets you skip the spreadsheets, ensure more peace of mind around accuracy, and save up to 6.8 hours each month as you automate expense tracking. The mobile receipt scanning makes it simple to auto-capture the merchant, totals, and tax details, so you’re sure you won’t miss a deduction. FreshBooks can streamline your process with features like automated expense tracking software, customizable invoicing with our invoicing software, and financial reporting. Automating the work ahead of time streamlines your tax preparation and gives you real-time feedback so you can adjust your choices to maximize your expenses and get the most tax savings possible. Taxes can take a significant bite out of your take-home pay but it’s something everyone has to live with.