An exclusive list of documents that are acceptable for this purpose is included in the Instructions for Form W-7. Some examples of acceptable documentation include national identification card (showing photo, name, current address, date of birth, and expiration date), civil birth certificate, foreign driver’s license, or visa issued by the Department of State. IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. The application must be attached to a valid federal income tax return unless the individual qualifies for an exception. You can file Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with your federal income tax return.

The identity documents must verify both your identity and your foreign status. Nonresident aliens claiming tax treaty benefits must submit original documents or copies certified by the issuing agency. Dependents of U.S. military personnel are required to submit original documents or certified copies unless the required documents to prove foreign status and identity are notarized by an agent of the Department of Defense.

Expanded discussion of allowable tax benefit

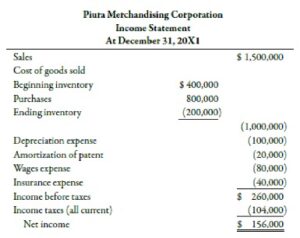

To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual. You may either mail the documentation, along with the Form W-7, to the address shown in the Form W-7 Instructions, present it at IRS walk-in offices, or process your application through an Acceptance Agent authorized by the IRS. Form W-7(SP), Solicitud de Número de Identificación Personal del Contribuyente del Servicio de Impuestos Internos is available for use by Spanish speakers. You will only file a tax return to the income statement the address above once, when you file Form W-7 to get an ITIN.

You can apply for an ITIN any time during the year when you have a filing or reporting requirement. At a minimum, you should complete Form W-7 when you are ready to file your federal income tax return by the return’s prescribed due date. If the tax return you attach to Form W-7 is filed after the return’s due date, you may owe interest and/or penalties. This interview will help you determine if you should file an application to receive an individual taxpayer identification number (ITIN). An ITIN is a tax processing number, issued by the Internal Revenue Service, for certain resident and nonresident aliens, their spouses, and their dependents. Those affected by Hurricane Beryl in Texas and Hurricane Debby in some states in the Southeastern United States have more time to file federal tax returns and make certain tax payments.

They review the applicant’s documentation and forward the completed Form W-7 to IRS for processing. You will need to complete Form SS-5, Application for a Social Security Card PDF. You also must submit evidence of your identity, age, and U.S. citizenship or lawful alien status. For more information please see the Social Security Administration website. For more information see Allowable Tax Benefits in the Instructions for Form W-7 PDF. If you’re a US citizen who regularly files taxes, you likely have a Social Security number.

TURBOTAX DESKTOP GUARANTEES

- If you’re a US citizen who regularly files taxes, you likely have a Social Security number.

- A foreign entity that completes Form SS-4 in the manner described above should be entered into IRS records as not having a filing requirement for any U.S. tax returns.

- It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S.

All features, services, support, prices, offers, terms and conditions are subject to change without notice. Simple Form 1040 returns only (no schedules except for Earned Income Tax Credit, Child Tax Credit and student loan interest). Acceptance Agents are equity and fixed income entities (colleges, financial institutions, accounting firms, etc.) who are authorized by the IRS to assist applicants in obtaining ITINs.

More In Credits & Deductions

In subsequent years, when you have an ITIN, you will file your tax return as directed in the form instructions. An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify ifrs vs gaap a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Refer to Employer ID Numbers for more information.The following form is available only to employers located in Puerto Rico, Solicitud de Número de Identificación Patronal (EIN) SS-4PR PDF. ITIN holders must verify their identity through the video chat process and will need a valid email address, proof of ITIN, one primary document and one secondary document.

But due to potential processing delays, it’s advisable that you add some extra wiggle room. This is especially true if you’re mailing your ITIN application to the U.S. from overseas as an expat or non-resident. ITINs that have not been used on a tax return for Tax Year 2020, Tax Year 2021 or Tax Year 2022 will expire December 31, 2023. Unless you will not need to file an income tax return next year, you will likely need to renew your ITIN if you fit either of the above two categories. An Individual Taxpayer Identification Number (ITIN) is a 9-digit number the Internal Revenue Service (IRS) issues to people filing a tax return who are not U.S. citizens and who do not have or are not eligible for a Social Security number. If you are not a U.S. citizen and do not have a Social Security number, learn how to get and use an Individual Taxpayer Identification Number (ITIN) to file a federal tax return.

You must also include original documentation or certified copies from the issuing agency to prove identity and foreign status. The Individual Tax Identification Number, or ITIN, allows taxpayers who don’t have a Social Security Number (SSN) to file income tax returns. Unlike other forms of ID, ITINs only have one purpose—tax filing and reporting.

What do I do if my name has changed since I received my ITIN?

If you qualify for an exception, then file Form W-7 with your proof of identity and foreign status documents and supporting documentation for the exception. An ITIN is issued for federal tax filing purposes only and doesn’t entitle you to Social Security benefits nor does it make you eligible for the earned income credit. The ITIN creates no inference concerning your immigration status or your right to work in the United States.